Monetary policy in the United States is determined by the Federal Open Market Committee (FOMC), a decisionmaking body that includes regional representation. Evidence shows that the economic conditions in their respective regions have influenced how presidents of the 12 regional Federal Reserve Districts voted at the FOMC meetings in past decades. Specifically, a 1 percentage point higher unemployment rate in a District relative to the national average is associated with a 9 percentage point higher probability of dissenting in favor of looser policy during the FOMC vote.

The Federal Reserve System consists of a Board of Governors based in Washington, DC, and 12 regional Federal Reserve Districts operating within different geographic areas across the United States. The Federal Reserve System is responsible for determining the nation’s monetary policy, specifically through voting at meetings of the Federal Open Market Committee (FOMC). In setting monetary policy, the FOMC pursues a dual mandate, seeking to mitigate deviations of inflation from its longer-run goal of 2% and shortfalls of employment from its maximum level.

While the Federal Reserve System was created with national goals, its District structure was designed to also provide regional input for its decisionmaking process. The FOMC participants include the Governors from the Federal Reserve Board and the presidents of the regional Federal Reserve Districts.

In this Economic Letter, we summarize the key findings of Bobrov, Kamdar, and Ulate (2024), who explore whether the regional structure of the FOMC matters for monetary policy. We focus on how local economic conditions in different Federal Reserve Districts influenced the policy preferences of District presidents at FOMC meetings during the period 1990–2017. Specifically, we analyze whether the voting patterns of District presidents change when there is an increase in the difference between the unemployment and inflation levels in their regions and the respective national average. Our findings suggest that District presidents are more likely to vote in favor of looser monetary policy—providing more accommodation through lower interest rates—when the difference between the unemployment rate in their Districts and the national average increases. When the difference in unemployment rates decreases, presidents are more likely to vote for tighter monetary policy—meaning more restrictive policy through higher interest rates. By contrast, an increase in the difference between the level of inflation in a given District and the national average appears to have no systematic impact on the votes cast by District presidents.

Structure of the Federal Reserve System

Since its inception, the Federal Reserve System has sought to balance regional interests with the setting of national monetary policy. This balance is reflected in the Federal Open Market Committee’s composition, which combines nationally appointed Governors with regionally affiliated District presidents.

The FOMC consists of 19 members. Seven of these members are Governors, appointed by the U.S. President and confirmed by the U.S. Senate to serve on the Federal Reserve Board in Washington, DC. These Governors have a vote at every FOMC meeting.

The other 12 members of the FOMC are the presidents of the regional Federal Reserve Districts, each nominated by the local boards of directors of their respective Districts and subject to the approval of the Board of Governors. While all District presidents participate in policy discussions at the FOMC meetings, only five presidents vote in any given year, based on a set rotation. The president of the New York Fed serves as a permanent voting member of the FOMC due to that District’s important role in conducting open market operations. The presidents of the Cleveland and Chicago Feds alternate as voting members every other year; this reflects the economic influence of the Ohio River Valley and the manufacturing and transportation industries based in Chicago in the early 20th century when the Federal Reserve System was established. The presidents of the remaining Federal Reserve Districts vote once every three years on a rotating basis from three groups—Boston, Philadelphia, and Richmond; Atlanta, St. Louis, and Dallas; and Minneapolis, Kansas City, and San Francisco.

The presence of District presidents at the FOMC meetings brings up the question of whether these regionally affiliated members take into consideration the economic conditions in their respective regions when they make monetary policy decisions. Each District gathers qualitative assessments for the Beige Book—a collection of reports from across the Federal Reserve System that provides a snapshot of the American economy before each scheduled FOMC meeting. Anecdotal evidence described in Bobrov et al. (2024) suggests that regional Bank presidents do consider their District’s conditions when assessing the state of the overall economy. Whether this can be detected in actual FOMC voting behavior requires a District-level data set, which we now turn to describing.

What does dissent look like?

To quantify whether regional economic conditions influence presidents’ voting behavior, we construct a data set of District-level inflation and unemployment. However, as the map of the Federal Reserve System in Figure 1 shows, the 12 Districts are not consistently divided along state lines, and 14 states are split, belonging to more than one District. We therefore use county-level labor force data from the Bureau of Labor Statistics, aggregated by District, to construct a measure of the District-level unemployment rate. We use state-level inflation data from Hazell et al. (2022) to focus on nontradable inflation. This measure tries to capture the prices of products that are specific to a given region instead of reflecting prices of similar items that are traded across the United States. Using this measure helps isolate the prices that affect local economies, placing a stronger emphasis on services, information that may therefore be more salient to regional Fed presidents.

Figure 1

Map of the Federal Reserve System

Finally, we collect data from Thorton and Wheelock (2014) listing the voting history of Fed Governors and District presidents to track dissents in monetary policy votes. Dissents are categorized as being justified by a preference for looser or tighter policy, corresponding roughly to whether the respective District president was in favor of a lower interest rate—to stimulate the economy in a time of recession—or a higher interest rate—to cool down the economy.

In our baseline analysis, we exclude unscheduled meetings and votes from the New York Fed president, who plays an institutional role as the FOMC Vice Chair and who historically tends not to dissent. Our sample spans the period from 1990 to 2017 and contains 896 votes by the presidents of Districts other than New York. Of those 896 votes, 17 are dissents in favor of looser policy, and 82 are dissents in favor of tighter policy.

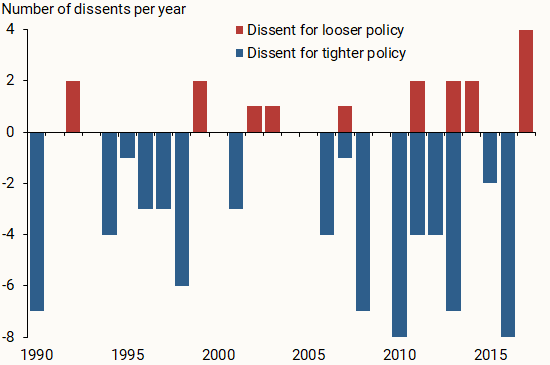

Figure 2 displays the number of dissents per year in the sample. Dissents in favor of looser monetary policy are displayed as positive values and shown in red, while those in favor of tighter policy are displayed as negative values and shown in blue. Some years have both blue and red bars, as they include dissent votes in favor of tighter and looser policy simultaneously, albeit by presidents of different Districts.

Figure 2

FOMC dissents per year, 1990-2017

Dissents have been on the rise in the past few decades. Our sample contains only 33 dissents between 1990 and 2005—averaging around two dissents per year. That rose to 66 total dissents between 2006 and 2017—averaging 5.5 dissents per year.

We use the aforementioned sample to estimate how District-level unemployment and inflation impact the probability of dissent in favor of looser or tighter monetary policy. In order to do this while controlling for potential confounding factors, we use a statistical technique known as fixed-effects regression. This approach allows us to account for the possibility that different District presidents might have different approaches to the monetary policy decisionmaking process—meaning that they mostly favor looser or tighter policy depending on their traits or personality—and for potential differences in the long-term level of unemployment for different Districts and the nation as a whole.

We find that an increase of 1 percentage point in District unemployment is associated with a 9.2 percentage point increase in the probability of the respective president dissenting in favor of looser policy. The first column of Figure 3 displays this, along with a band indicating the range of statistical uncertainty around the estimate.

Figure 3

Influence of regional unemployment on dissent

Previous research on FOMC voting patterns suggests that Chair Alan Greenspan may have had a chilling effect on dissenting votes at the FOMC. To test this hypothesis, we split our sample into the Greenspan era (1990–2005), shown in the second column of Figure 3, and the post-Greenspan era (2006–2017), shown in the third column. In the Greenspan era, we cannot statistically distinguish the influence of District unemployment on dissent from zero. However, in the post-Greenspan era, a 1 percentage point higher District unemployment rate is associated with a 13.3 percentage point higher probability of dissenting in favor of looser policy. This relationship is statistically distinguishable from zero.

In contrast to the influence of local unemployment on dissent, the influence of local inflation on dissent does not appear to be statistically detectable during our sample for several reasons. For example, local inflation is measured at the state level rather than the county level, so aggregation to the Fed District level is imperfect. Further, the Hazell et al. (2022) data that we use for inflation measurement are limited to 35 states and may not reflect overall inflation in each state due to a focus on selected large cities. Also, inflation is measured quarterly rather than monthly.

Conclusion

This Letter provides support for the notion that regional economic conditions can influence the voting behavior of District members of the FOMC. Specifically, focusing on the period 1990–2017, we find that a 1 percentage point higher District unemployment rate increases the likelihood that the respective District president will dissent in favor of looser policy at the FOMC by around 9 percentage points.

The influence of local economic conditions on dissents by District presidents reflects the regional structure of the Federal Reserve System, which was designed to accommodate diverse views across the nation. Unemployment data likely reinforce District presidents’ direct observations of their own regional economies, and this combined information may be particularly salient in forming their expectations about the direction of the national economy. Regardless of the cause, our evidence suggests that District presidents consider regional unemployment when they vote at the FOMC.

References

Bobrov, Anton, Rupal Kamdar, and Mauricio Ulate. 2024. “Regional Dissent: Do Local Economic Conditions Influence FOMC Votes?” Forthcoming in American Economic Review: Insights; available as FRB San Francisco Working Paper 2024-05.

Hazell, Jonathon, Juan Herreño, Emi Nakamura, and Jón Steinsson. 2022. “The Slope of the Phillips Curve: Evidence from U.S. States.” Quarterly Journal of Economics 137(3), pp. 1,299–1,244.

Thornton, Daniel L., and David C. Wheelock. 2014. “Making Sense of Dissents: A History of FOMC Dissents.” FRB St. Louis Review 96(3), pp. 213–227.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org